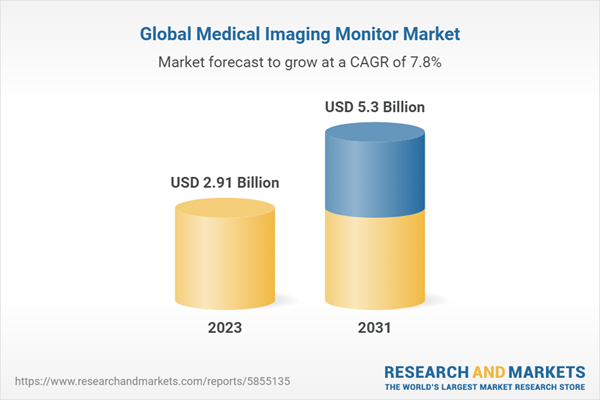

The global medical imaging monitor market value was USD 2.7 billion in 2022, driven by the increasing advancements in medical imaging technology across the globe. The market size is anticipated to grow at a CAGR of 7.8% during the forecast period of 2023-2031 to achieve a value of USD 5.3 billion by 2031.

The market for medical imaging monitors is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical imaging technology, and the rising demand for improved patient care. The need for high-resolution displays, wide colour gamut, and multi-modality support is pushing the development of advanced imaging monitors. Additionally, the integration of these monitors with Picture Archiving and Communication Systems (PACS) and the demand for remote viewing and collaboration capabilities are driving market growth.

In conclusion, the medical imaging monitor market is driven by technological advancements, increased healthcare needs, and the demand for efficient and accurate diagnostic tools. With ongoing innovations and advancements, medical imaging monitors are poised to continue playing a vital role in improving patient outcomes and enhancing healthcare delivery.

Medical Imaging Monitor: Introduction

Medical imaging monitors are specialized displays used for the visualization and interpretation of medical images, such as X-rays, CT scans, MRIs, and ultrasound images. These monitors are designed to meet the high standards of image quality, accuracy, and consistency required in the field of radiology and medical imaging. Medical imaging monitors are equipped with advanced technologies that enable the precise rendering of grayscale and color images, ensuring optimal visualization of anatomical structures and pathological findings. They are typically high-resolution displays with high luminance and contrast ratios to enhance image clarity and detail. These monitors are calibrated and compliant with industry standards, such as DICOM (Digital Imaging and Communications in Medicine), which ensures consistency and accuracy in image interpretation across different devices. They also offer various image enhancement and adjustment features, allowing radiologists and clinicians to optimize image quality and manipulate images for better visualization.Key Trends in the Global Medical Imaging Monitor Market

Some key trends in the medical imaging monitor market include:

- Advancements in Display Technologies: There is continuous development in display technologies, such as OLED (Organic Light Emitting Diode) and QLED (Quantum Dot Light Emitting Diode), which offer improved color accuracy, contrast ratios, and wider viewing angles. These technologies enhance the visualization and interpretation of medical images, enabling more accurate diagnoses

- High-Resolution Displays: The demand for high-resolution displays, such as 4K and 8K monitors, is increasing. These monitors provide greater pixel density, allowing for more detailed and precise image rendering. High-resolution displays are particularly beneficial for complex medical imaging procedures and surgical applications

- Wide Color Gamut: Monitors with wide color gamut capabilities, such as those compliant with the DCI-P3 or Adobe RGB color spaces, are becoming more popular. These monitors can reproduce a broader range of colors, enabling better visualization of subtle variations and enhancing the diagnostic accuracy

- Multi-Modality Support: With the integration of multiple medical imaging modalities in healthcare facilities, there is a growing need for monitors that can display different types of medical images seamlessly. Multi-modality support allows clinicians and radiologists to view and compare images from various modalities on a single monitor, improving workflow efficiency

- Ergonomic Design and User Experience: There is an increasing focus on the ergonomic design of medical imaging monitors to improve user comfort and reduce fatigue during prolonged viewing sessions. Features such as adjustable stands, anti-glare coatings, and customizable display settings enhance the user experience and facilitate efficient image interpretation

Global Medical Imaging Monitor Market Segmentations

Market Breakup by Devices

- Mobile

- Desktop

- All-in-one

Market Breakup by Panel Size

- Under-22.9-inch Panels

- 23.0-26.9-inch Panels

- 27.0-41.9-inch Panels

- Above-42-inch Panels

Market Breakup by Type

- Diagnostic Monitors

- Surgical Monitors

- Clinical Monitors

- Others

Market Breakup by Display Color

- Monochrome

- Coloured

Market Breakup by Purpose

- Doppler

- Encoding

- Enhanced 3D Reconstruction Contrast Enhancement

- Others

Market Breakup by Technology

- LED-Backlit LCD

- OLED

- CCFL-Backlit LCD

Market Breakup by Applications

- Digital Pathology

- Multi-modality

- Surgical

- Radiology

- Endoscope

- Mammography

- Others

Market Breakup by Modality

- X-Ray Plain Film

- Computed Tomography (CT)

- MRI

- Others

Market Breakup by Resolution

- Up to 2 MP

- 2.1-4 MP

- 4.1-8 MP

- Above 8 MP

Market Breakup by Grade

- Surgical

- Diagnostic

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Medical Imaging Monitor Market Scenario

The medical imaging monitor market plays a critical role in healthcare, providing clinicians, radiologists, and surgeons with accurate and detailed visual representations of medical images. These monitors are specifically designed to meet the demanding requirements of medical imaging, ensuring precise image rendering and diagnostic accuracy.The market for medical imaging monitors is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical imaging technology, and the rising demand for improved patient care. The need for high-resolution displays, wide colour gamut, and multi-modality support is pushing the development of advanced imaging monitors. Additionally, the integration of these monitors with Picture Archiving and Communication Systems (PACS) and the demand for remote viewing and collaboration capabilities are driving market growth.

In conclusion, the medical imaging monitor market is driven by technological advancements, increased healthcare needs, and the demand for efficient and accurate diagnostic tools. With ongoing innovations and advancements, medical imaging monitors are poised to continue playing a vital role in improving patient outcomes and enhancing healthcare delivery.

Global Medical Imaging Monitor Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Siemens Healthineers AG

- Advantech Co Ltd

- Steris Corporation

- Jvckenwood Corporation

- Canon Inc

- FSN Medical Technologies

- Novanta Inc

- EIZO Corporation

- Barco NV

- Alpha Display Co. Ltd

- LG Display Co., Ltd

- Sony Corporation

- BenQ Medical Technology Corporation

- Nanjing Jusha Commercial &Trading Co, Ltd

- Hisense Medical

- COJE Co., Ltd

- Shenzhen Beacon Display Technology Co., Ltd

- Dell Technologies Inc

- Quest International, Inc

- Double Black Imaging Corporation

Table of Contents

1 Preface

3 Global Medical Imaging Monitor Market Overview

4 Global Medical Imaging Monitor Market Dynamics

5 Global Medical Imaging Monitor Market Segmentation

6 North America Medical Imaging Monitor Market

7 Europe Medical Imaging Monitor Market

8 Asia Pacific Medical Imaging Monitor Market

9 Latin America Medical Imaging Monitor Market

10 Middle East and Africa Medical Imaging Monitor Market

11 Patent Analysis

12 Grants Analysis

13 Funding Analysis

14 Partnership and Collaborations Analysis

15 Regulatory Framework

16 Supplier Landscape

17 Global Medical Imaging Monitor Market - Distribution Model (Additional Insight)

19 Company Competitiveness Analysis (Additional Insight)

20 Payment Methods (Additional Insight)

Companies Mentioned

- Siemens Healthineers AG

- Advantech Co Ltd

- Steris Corporation

- Jvckenwood Corporation

- Canon Inc.

- FSN Medical Technologies

- Novanta Inc.

- EIZO Corporation

- Barco NV

- Alpha Display Co. Ltd.

- LG Display Co., Ltd

- Sony Corporation

- BenQ Medical Technology Corporation

- Nanjing Jusha Commercial &Trading Co, Ltd

- Hisense Medical

- COJE Co., Ltd.

- Shenzhen Beacon Display Technology Co., Ltd.

- Dell Technologies Inc.

- Quest International, Inc.

- Double Black Imaging Corporation

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | July 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 2.91 Billion |

| Forecasted Market Value ( USD | $ 5.3 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |